Cronos ETF and Stablecoin Launch in 2025 – CryptoNinjas

Key Takeaways:

- Crypto.com plans to launch the Cronos ETF in Q4 2025 to attract institutional investors.

- In addition to cryptocurrency trading, the platform now offers stocks and multicurrency accounts, and is actively developing a stablecoin.

- The CRO token faces selling pressure despite the platform’s ambitious plans.

Crypto.com’s 2025 development plans have set an ambitious course. The company not only plans to launch a Cronos (CRO) ETF but also introduce a stablecoin. The introduction of these projects indicates the platform’s will to expand and the attempt to comprise both individual and institutional investors. However, can the company withstand the volatility of the crypto market and truly deliver on its promises? Let’s explore further.

Crypto.com Prioritizes Cronos ETF Launch

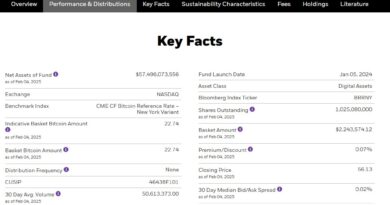

The exchange is preparing to register the Cronos (CRO) spot ETF and plans to launch it in Q4 2025. This decision is driven by the growing interest of investment firms in cryptocurrency. After the successful launch of Bitcoin ETFs, other firms are eagerly looking at capitalizing on the movement, with the goal of attracting investors to other platforms dedicated to digital currency.

Crypto.com Roadmap 2025

Spot Bitcoin ETFs have gained significant traction in the U.S. Bitwise CIO Matt Hougan reported that these ETFs accumulated $4.94 billion in January 2025 alone, with projections reaching $59 billion annually. The arrival of these funds indicates the existence of pent-up demand for regulated and the easy availability of crypto investment vehicles, which opens up the crypto industry to the traditional financial sector.

Cronos ETF is expected to give the investors indirect exposure to CRO assets. This, in turn, will give the token the necessary validation and extension that will lead to its faster adoption. This development can help CRO attract not only current crypto holders but also those who have not gotten into the business because of their fear of buying and managing a digital currency.

Expanding Services: Stocks, Stablecoins, and More

Crypto.com is not only exploring an ETF but also significantly expanding its offerings in Q1 2025, facilitated by the inclusion of such products as stocks, stock options, and other ETFs on the company’s platform. This metamorphosis will make it possible for Crypto.com to be both a traditional finance and at the same time, a digital asset platform. With this strategy, Crypto.com’s management team is making a bold move—one that could either solidify its leadership or expose it to significant risks.

In addition, the exchange will include updated banking functionalities as well, for example, personal multicurrency accounts and cash savings accounts. Among some of the new personal multicurrency accounts and cash savings options, users will have full control over their monies. Think about how easy it will be for you to manage all your currencies and money in one simple platform without having to transfer your money to different accounts across different banks.

The planned launch of a new stablecoin in Q3 2025 marks another major milestone. While details remain undisclosed, the company emphasizes its commitment to enhancing user experience and expanding financial services.

In a volatile crypto market, stablecoins serve the purpose of staying stable by being pegged to other less volatile assets, like fiat currency. Crypto.com’s stablecoin aims to enhance transaction efficiency and boost user confidence in the platform. The use of a well-designed stablecoin could dramatically enhance the overall user experience on the platform.

Regulatory Wins and Global Expansion

The company managed to secure a full European Union license under the Markets in Crypto-Assets Regulation (MiCA) framework, thereby having passed its own milestones already.

More News: MiCA Regulation: A New Dawn or a Dark Cloud for Europe’s Crypto Market?

President of Crypto.com Eric Anziani said that obtaining a MiCA license was very important and that it really is a top priority for them as the most compliant and regulatory crypto platform globally.

President of Crypto.com Eric Anziani

Crypto.com’s recent regulatory achievement is in line with their broader expansion strategy, making them able to present an extensive range of crypto services all over the EEA. The MiCA license is a good solid base for growth and builds up users’ confidences in the European market.

Market Challenges and CRO Performance

However, Crypto.com’s ambitious plans are burdened with significant headwinds. The CRO price has faced a sharp 35.7% decline over the past month, driven by broader market sell-offs and investor concerns about the token’s long-term value. Currently, CRO is at around $0.10 and this is because the market is experiencing a continuous selling pressure.

CRO’s performance plays a crucial role in Crypto.com’s overall market perception. A prolonged downtrend could weaken investor confidence, potentially impacting the success of upcoming products like the Cronos ETF and the stablecoin. A lackluster native token can overshadow even the most encouraging projects.

Institutional Interest and the Race for Altcoin ETFs

The battle to bring cryptocurrency ETFs on the market has taken a new turn as institutional exposure to digital assets is seeing a surge. Major asset managers such as VanEck, Grayscale, 21Shares, Bitwise, and Canary Capital have filed applications for Solana ETFs, signaling a growing institutional appetite for altcoin investment vehicles. This plainly shows that there is growing demand for all kinds of cryptocurrencies.

There are some out there who would think of the race for altcoins ETFs as an indication of the crypto market’s maturity and others who would stay skeptical about whether this product can be sustained in the future. The successfulness of these ETFs will mostly depend on their capability of generating enough interest from investors and on their liquidity consistency.

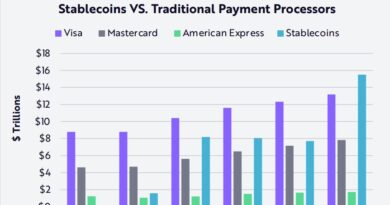

Stablecoins: A Key to Wider Adoption?

Crypto.com is also focusing on stablecoins. On the other hand, David Sacks, who is now the White House AI and crypto czar, is the one who insists on the need for secure legislation. He tells us the truth – that the well-regulated market of stablecoins may result in trillions of dollars in demand for the dollar and the drop of long-term interest rates of the digital finance sector by their increased share are the main ways of the blockchain to strengthen its position. He adds that it is a very urgent issue.

More News: Trump Signs Order to form Cryptocurrency Working Group and Prohibits CBDC

For example, Tether (USDT) recently reported a record profit of $13 billion, driven primarily by interest earnings on its reserves. This is a typical example that shows the extraordinary profitability and power of digital stable means of exchange in the economy. Stablecoins have entered the mainstream, they have become essential for the crypto environment.

Navigating a Shifting Regulatory Landscape

The regulation is a major factor, especially in the United States, which determines the outcomes of crypto initiatives like that of the Cronos ETF or stablecoin. Even though the sector expects some more protracted positive changes in the regulatory field, working through the intricacies of securities laws and compliance mandates is a real daunting task. Uncertainty in regulation can create hurdles.

Balancing Innovation and Compliance

The venture of Crypto.com is truly exciting but also somewhat nerve-wracking when we start bundling it with regulatory and market challenges. Creating an exchange-traded fund (ETF) and stablecoin necessitates a huge investment in both human and financial resources, especially if the market is evolving rapidly. The fact that the company has taken serious steps to get approval from regulators cannot be overlooked, but further obstacles may still arise. Can they manage the complex situation successfully?