Is it a Safe and Legit Exchange?

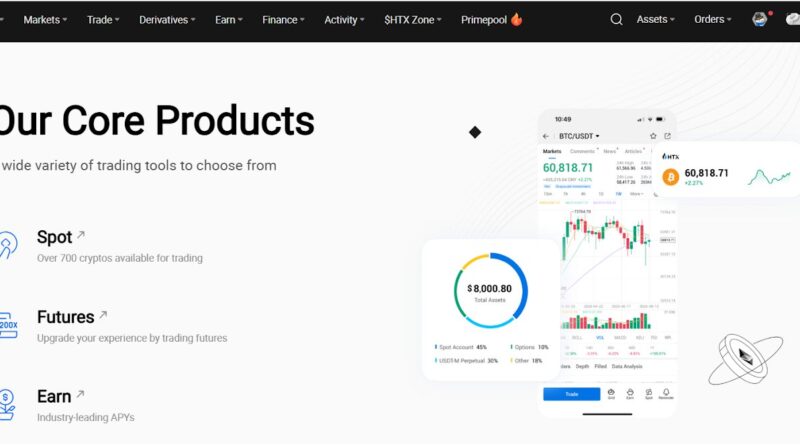

HTX is the best crypto exchange that started in 2013 as Huobi and became HTX in 2023. It is based in Seychelles and serves millions of users worldwide. The exchange lets you trade 700 coins, and you can deposit 100+ fiat currencies to buy and sell crypto.

The best features of the HTX exchange are its “Pro” trading features, including 200x perpetual futures trading, copy trading, and margin trading, along with an HTX wallet HTX token. The exchange is suitable for both beginners who want a simple way to start trading and experienced traders looking for many options and high volume.

In this Huobi HTX review, we will cover what HTX is, what the key features of HTX are, and what Huobi HTX fees are. We will also explain how to create a new account to trade crypto on HTX with a step-by-step guide.

What is HTX (Huobi Rebrand)?

HTX is one of the top cryptocurrency exchanges founded in 2013 as Huobi. The exchange is headquartered in Seychelles and hosts over 50 million customers globally. It operates in more than 160 nations and has representative offices in Hong Kong, South Korea, Japan, and the United States. The exchange has been prominent in trading Bitcoin, Ethereum, and over 700 other digital assets. It changed its name from Huobi to HTX in 2023.

According to CMC data, it processes a trade volume of over $4 billion per day. Also, it has $3.74 billion in reserve assets. HTX offers spot trading, futures trading for up to 200x, and margin trading for 5x. There is a trading fee of 0.2% for makers and takers, which can also be discounted by using HTX tokens. It also provides trading bots, custody services, and earn products for passive income.

HTX is not only a trading platform but also operates a blockchain ecosystem that has research, investments, and a decentralized community known as HTX DAO. The exchange is also engaged in new domains, such as Web3 and decentralized finance (DeFi). Recently, it also established Inno Hub to nurture high-potential blockchain projects.

| Founded | 2013 (as Huobi), rebranded to HTX in 2023 |

| Headquarters | Victoria, Seychelles |

| Supported Coins | 700+ cryptocurrencies |

| Trading Features | Spot trading, margin trading (5x), futures trading (200x), copy trading, trading bots |

| Fees | Spot: 0.2% maker/taker, Futures: 0.02% maker, 0.06% taker |

| Security | 2FA, cold storage, multi-signature wallets, investor protection fund, SSL encryption |

| Supported Countries | 160+ countries (not available in the USA) |

| KYC Requirement | Yes (mandatory) |

Are you a new user? You can register now with our HTX referral code to claim a 1,200 USDT sign-up bonus.

What are the Pros and Cons of HTX?

HTX Pros:

The pros of HTX are a wide range of supported coins, advanced trading tools, high trading volume, and high security measures.

- Wide supported coins: It provides an enormous variety of more than 700 cryptocurrencies for users to venture into popular and specialized digital assets.

- Advanced trading tools: The exchange also has sophisticated trading functions, such as margin trading and derivatives trading, alongside TradingView charting.

- High trading volume: HTX trading platform users can enjoy high liquidity through its massive trading volume that provides zero price slippage.

- High security: It has robust security measures, including 2FA and cold storage, to safeguard your funds.

HTX Cons:

The cons of HTX are U.S. unavailability, high trading fees, and slow customer support response times.

- No U.S. availability: HTX limits access for users from regions such as the U.S., and this is because of regulatory hurdles.

- High fees: It levies exorbitant fees (0.2% maker/taker) instead of following the industry norm of 0.1% maker/taker.

- Slow customer support: The exchange is given mixed customer service reviews as some users experience delays in response.

Where is HTX Located?

HTX is located in Victoria, Seychelles. Seychelles is a small island country in the Indian Ocean, and it is very famous for crypto companies like HTX because of its crypto-friendly laws.

The exchange also operates offices in other locations, such as Hong Kong, South Korea, Japan, and the United States, but its headquarters is in Victoria. It started operations in China in 2013 under the name Huobi, but since China prohibited the operation of crypto exchanges in 2017, it relocated its core operations to Seychelles.

What are HTX Supported Countries?

The HTX supported countries are over 160 nations worldwide, including Australia, Brazil, Dubai, and South Korea. It provides services such as trading, staking, and lending for digital currencies like Bitcoin and Ethereum in these areas.

It also offers assistance in 15 languages and supports over 100 deposit fiat currencies. But, some areas are restricted, primarily because of local rules or security regulations, so not all countries are granted full access.

Is HTX Available in the USA?

HTX is not available in the USA. The exchange prohibits users from the United States from accessing its services due to strict U.S. regulations on cryptocurrency trading. This ban also applies to other countries like China, Japan, and Singapore, but the U.S. stands out due to its tough financial laws.

What Does HTX Stand For?

HTX stands for Huobi, TRON, and Exchange. The name is broken down as follows: “H” stands for Huobi, the company’s original name when it was established in 2013; “T” stands for TRON, it’s a blockchain associated with founder Justin Sun; and “X” stands for the exchange itself.

What Are the Key Features of HTX?

The best features of the HTX exchange are its “Pro” trading features, including 200x futures contracts, copy trading, and margin trading, along with an HTX wallet and its governance token called “HTX”.

You can use our HTX referral code when you join to receive a 1,200 USDT bonus and save up to 20% on trading fees.

HTX (Huobi) Pro

HTX Pro is not a separate platform but a term sometimes used to describe the advanced features of the HTX exchange. It is essentially the full HTX platform that covers tools and services beyond basic spot trading.

As the exchange rebranded to HTX, it dropped the “Pro” label as a distinct entity. And instead, it integrates all pro-level features into one unified system.

There are advanced trading options as a Pro feature. It includes futures trading with up to 200x leverage on perpetual contracts for Bitcoin, Ethereum, Solana (SOL), and over 100 other cryptocurrencies. HTX supports both USDT-margined and coin-margined futures. The exchange also provides options trading.

Also, there is a robust trading interface with detailed charts and technical indicators. It is built for crypto traders who need real-time data, like price alerts and market depth (like order book). You can also use the copy trading feature, where you can follow and copy the moves of top traders to earn profits along with learning different trading strategies.

Note: HTX does not restrict these “Pro” features to any specific user group. It makes them available for all verified users.

What is the difference between HTX Pro and regular HTX?

HTX is a unified platform, so the difference between “HTX Pro” and regular “HTX” is more about the way that users interact with its features than a physical division.

The exchange has all services, simple and advanced, on one system only since its 2023 rebrand from Huobi Global. So, regular “HTX” is used more for basic buy/sell crypto, while “HTX Pro” covers all the advanced features like leverage trading, copy trading, auto trading bots, staking, and more.

Margin Trading

HTX offers margin trading as a key feature for you if you want to boost your trading power. Simply, this means you can borrow funds from the exchange to trade larger amounts than you own, multiplying profits (or even losses, too). The exchange supports margin trading on over 80 cryptocurrencies, including Bitcoin, Ethereum, and XRP, and with leverage up to 5x on spot markets.

There are two margin modes you can use: cross margin and isolated margin. Cross margin uses all your available funds in a margin account to cover all losses across positions. An isolated margin is mainly limiting borrowing to a single trade only, not full account. HTX calculates interest on these borrowed funds hourly, with rates varying by coin.

The exchange also requires a margin deposit, which is called initial margin, to secure the loan. It is typically around 20% of the borrowed amount for 5x leverage.

HTX ensures safety with different risk management tools integrated natively for you. It sets a margin call level at 120% and a liquidation level at 110%. Also, if your trade’s value drops too far, the exchange warns you first to add funds, and you can close the position to avoid bigger losses. It also offers futures margin trading with up to 200x leverage.

HTX Wallet

HTX provides a wallet service as part of its platform to store and manage cryptocurrencies. The wallet is mainly integrated into the exchange, so you don’t need a separate app for this, and your funds stay in your HTX account only for trading, earning, or withdrawals. The exchange supports over 700 crypto assets in its wallet, including Bitcoin, Ethereum, HTX, and other low-cap altcoins.

HTX wallet splits into different accounts for specific uses as you require. It includes a Spot account for regular trading, a Futures account for derivatives, a Fiat account for P2P purchases, an Earn account for staking, and a Margin account for borrowed funds. You can easily transfer assets between these accounts manually via the HTX interface, which generally takes only a few clicks, and there are no extra fees.

HTX secures its wallet with both hot and cold storage options. It keeps most of its funds offline in cold wallets, while a small portion stays in hot wallets for your regular transactions. The exchange also uses multi-signature technology and Proof of Reserves so that users can verify that it holds 100% of their funds.

HTX Coin

HTX is the native cryptocurrency of the HTX exchange. This comes after rebranding from Huobi Token (HT) to align more with the platform’s new identity. It is an ERC-20 token and is also available on other networks like TRC-20 and BEP-20. HTX mainly serves as a utility token that offers benefits like fee discounts, governance rights, and rewards within the HTX ecosystem.

The exchange caps the HTX token at a total supply of 1 billion tokens. HTX token provides trading fee discounts to holders. The exchange offers a base fee of 0.2% for spot trades, but users holding HTX can lower this by up to 25%. The coin’s current market cap is $1.77B (at the time of writing).

What Are Huobi HTX Fees?

HTX’s trading fees are 0.2% for both makers and takers in the spot market. It does not charge deposit fees, but you need to pay network fees for withdrawals.

| Deposit Fees | Free for all cryptocurrencies; network fees may apply |

| Withdrawal Fees | Varies by network (but generally higher than other exchanges) |

| Trading Fees |

|

Deposit and Withdrawal Fees

HTX does not charge any fees from you for depositing cryptocurrencies into your account. This means you can easily transfer Bitcoin, Ethereum, or any other supported cryptocurrency to your HTX wallet without paying the exchange a fee.

HTX charges a fee when you withdraw cryptocurrencies from your account to another wallet or crypto exchange. Here, the exact fee depends on the cryptocurrency you’re withdrawing and the blockchain network conditions. For Bitcoin, HTX’s withdrawal fee is 0.00025 BTC. For Ethereum, the fee is 0.0021 ETH.

However, these fees are not stable and always change over time. The fee might increase slightly as network congestion increases to ensure that your transaction gets processed quickly. HTX also lists the most current withdrawal fees on its website under the “Withdrawal” section, so you can easily check the exact amount before transaction confirmation.

Note: During our HTX review, we have noticed that it charges slightly higher withdrawal fees compared to other exchanges like Binance, Bybit, or MEXC.

Trading Fees

HTX charges trading fees when you buy or sell cryptocurrencies on its exchange. The exchange mainly operates on a maker/taker fee structure. This means that makers provide liquidity by placing limit orders that don’t match immediately, and takers take liquidity by placing market orders that match instantly.

For new users, the default trading fees are 0.2% for both makers and takers. The exchange also offers lower fees for high trading volume or you must hold HTX Token (HTX).

For futures trading, fees differ slightly – makers have to pay 0.02% and takers 0.06%. Similar to spot trading, you will get a discount based on your trading volume.

How To Create a New Account to Trade Crypto on HTX?

To create a new account to buy crypto on HTX, you need to complete KYC verification on HTX, deposit fiat or crypto, and start trading cryptocurrency.

Step 1: Create an HTX Account and Complete KYC

Firstly, you have to go to the official HTX website. Find the “Sign Up” button on the top right-hand side of the homepage and click it. You can sign up with your email address or mobile phone number.

You can also use our HTX referral code during registration to get a 1,200 USDT sign-up bonus and up to 20% trading fee rebates.

Now, as you fill in the details, you need to agree to the HTX User Agreement and Privacy Policy, then simply click “Sign Up.” HTX will send you a verification code to your email or phone – enter this 6-digit code to confirm your account.

Then, the exchange asks you to undergo KYC verification to access all trading features. Go to your profile icon and choose “KYC L1” from the drop-down menu. HTX will request you to upload your full name, nationality, and government-issued ID, such as a passport or driver’s license. You have to upload clear images of your ID and a selfie with it. Generally, the exchange processes this within 2 hours if all information is correct.

Step 2: Deposit Funds to Trade

HTX allows trading only once you deposit funds into the account. The exchange supports various deposit methods, including cryptocurrency and fiat currency like USD or EUR.

So, to deposit crypto, you must click “Assets” and then select “Deposit” from that drop-down list. Here, HTX will display all supported cryptocurrencies – let’s use USDT (Tether) as an example since it’s popular. Choose USDT, and the exchange will generate a unique deposit address (e.g., 0x123abc…). You need to copy this address or scan its QR code. Now, open your external wallet (e.g., MetaMask or Coinbase), paste this address, and send at least 1 USDT.

You can also deposit fiat currency using a debit/credit card or bank transfer. You just need to go to the “Buy” section, select “P2P” or “Quick Buy/Sell”, and now, follow the steps to complete the transaction. If you’re unsure which assets to invest in, HTX provides access to some of the best cryptocurrencies to buy, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Step 3: Start Trading Crypto

Now, click “Trade” at the top, and then you have to choose “Spot”. HTX displays a trading interface with pairs such as BTC/USDT. Select your pair – let’s say you wish to buy Bitcoin with USDT. Scroll down to the “Buy/Sell” area below the chart. HTX offers 2 common order types: Limit and Market order. You need to input the amount, and HTX will compute the price. Simply click “Buy BTC” to submit your buy order.

After trading, HTX will update your account balance. You can check it under “Assets”. You can also sell BTC similarly. The exchange also offers more advanced options like “TP/SL” (Take Profit/Stop Loss) to manage risks, but as a beginner, you should start with the basics.

Is HTX Legit and Safe?

Yes, HTX is a legit and safe crypto exchange, ensuring safety with 2FA, cold storage, multi-signature wallets, an investor protection fund, SSL encryption, anti-DDOS protection, KYC verification, an anti-phishing code, and address whitelisting.

- Two-factor authentication (2FA): HTX mandates users to activate 2FA, which requires an additional step to log in. You need your password along with a code from your phone or email.

- Cold Storage: The exchange holds 98% of its digital assets in cold wallets, which are offline and not internet-connected. This keeps the majority of funds secure from online attacks. Only a little remains online for trading.

- Multi-Signature Wallets: HTX employs multi-signature technology, so more than one key is required to transfer funds. This prevents any one individual or hacker from stealing funds with ease.

- Investor Protection Fund: HTX initiated this fund in January 2018, investing 20% of its quarterly earnings in buying back HTX tokens and holding them in reserve for emergencies. If something goes wrong, such as a hack, this fund ensures users get paid back.

- SSL Encryption: HTX employs SSL encryption to secure information you transmit to their website, such as your login credentials. This encrypts the data so that hackers are unable to access it.

- Anti-DDOS Protection: The exchange has measures in place to prevent Distributed Denial of Service (DDOS) attacks, whereby hackers bombard a website to bring it down.

- KYC Verification: HTX adheres to Know Your Customer (KYC) regulations, requesting ID and address proof when signing up. This prevents fraud and illicit uses on the site.

- Anti-phishing Code: This is an individual word or phrase you initialize in your account. The exchange incorporates this code into all actual emails they send you, which means you can identify phishing attempts by scammers impersonating HTX.

- Withdrawal Address Whiteslisting: It is an additional security measure in which you whitelist certain wallet addresses you intend to trust with withdrawals. Now, HTX will only allow money to be sent to these whitelisted addresses.

Does HTX Require KYC?

Yes, HTX requires KYC verification for all users who want to deposit and trade crypto. The exchange will ask you to submit ID documents, which can be a passport or driver’s license, and also proof of address, such as a utility bill, during sign-up or before trading.

As a new user, you can sign up today using our HTX referral code (Huobi coupons) to claim a 1,200 USDT welcome bonus.